In the modern financial landscape, where transactions are increasingly complex and interwoven with legal and regulatory frameworks, businesses and individuals alike face significant financial risks. Whether due to fraud, misreporting, or internal inefficiencies, financial mismanagement can have severe consequences. This is where forensic accounting audits play a crucial role in maintaining the integrity of financial operations.

What is Forensic Accounting?

Forensic accounting involves the application of specialized accounting skills to investigate financial discrepancies, uncover fraud, and provide expert financial analysis in the context of legal disputes or regulatory scrutiny. It is often used in situations where financial fraud or misconduct is suspected. The goal of forensic accounting is not just to identify financial issues but to offer evidence that can be used in legal proceedings, including court trials.

A forensic accounting audit goes beyond the traditional financial audit. While a standard audit focuses on ensuring that financial statements accurately reflect the company’s financial position, a forensic audit digs deeper, investigating the circumstances surrounding transactions and identifying potential criminal activity, fraud, or non-compliance with laws and regulations.

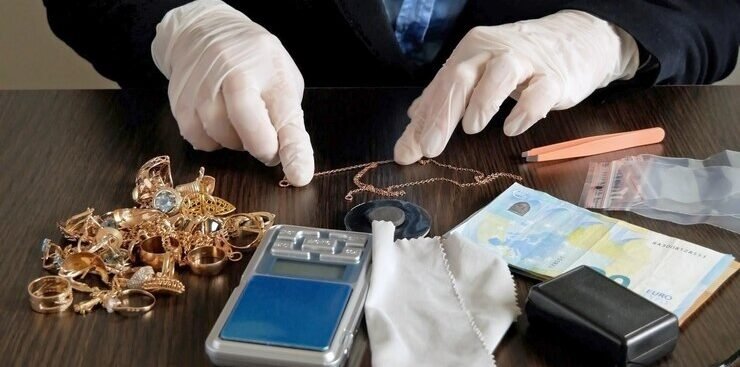

Forensic accountants utilize a combination of accounting skills, investigative expertise, and knowledge of legal proceedings to evaluate financial records and detect irregularities that may suggest fraud, embezzlement, tax evasion, or financial statement manipulation.

Why Are Forensic Accounting Audits Important?

The importance of forensic accounting audits cannot be overstated. Businesses face various risks, and the financial stakes are higher than ever before. Here are a few key reasons why forensic accounting audits are essential:

- Fraud Detection and Prevention: Fraudulent activities, including embezzlement, kickbacks, and financial misreporting, can severely damage an organization’s reputation and financial standing. A forensic accounting audit is designed to uncover such activities by examining financial records and transactional patterns.

- Legal Protection and Compliance: Forensic accountants can provide expert testimony in court and assist businesses in complying with relevant legal requirements. In the event of a financial dispute, having a forensic accountant can be the key to resolving the matter fairly and legally.

- Minimizing Financial Losses: By identifying financial discrepancies early, forensic accounting audits can help mitigate potential financial losses. Early detection of fraud or inefficiencies allows businesses to take swift corrective actions, reducing the overall impact on their financial health.

- Internal Control Improvements: Through forensic audits, companies can identify weaknesses in their internal control systems. These audits can lead to the development of more effective safeguards to prevent future financial mismanagement.

- Risk Management: In an increasingly risk-prone environment, businesses must be proactive about risk management. Forensic accounting auditshelp in identifying financial risks that could jeopardize an organization’s stability. By understanding where the vulnerabilities lie, businesses can take preventive steps to safeguard their financial future.

How Do Forensic Accounting Audits Work?

The process of conducting a forensic accounting audit involves several critical steps. These steps are designed to thoroughly examine financial records and ensure that any irregularities are identified and addressed.

- Initial Consultation and Case Assessment

The first step in any forensic accounting audit is to understand the nature of the case. This could be a suspected case of fraud, a dispute over financial transactions, or a concern about financial mismanagement. The forensic accountant will meet with the client, understand the context, and determine the scope of the audit.

- Planning and Scope Definition

Once the forensic accountant has a clear understanding of the situation, the next step is to define the scope of the audit. This involves deciding which areas of the business or financial records need to be examined. The forensic accountant may focus on specific transactions, departments, or periods of time.

- Data Collection and Documentation Review

The forensic accountant will gather financial records, transaction details, contracts, and other documents relevant to the case. This step involves reviewing everything from accounting books to emails, internal communications, and external contracts. A forensic accountant must ensure that the data is accurate, comprehensive, and properly documented.

- Analysis of Financial Data

After collecting the necessary data, the forensic accountant will analyze the information to identify any unusual patterns or discrepancies. This could include analyzing bank statements, credit card transactions, invoices, and receipts. The goal is to detect any financial activities that don’t align with standard business practices or seem suspicious.

- Interviews and Investigative Procedures

Forensic accountants often conduct interviews with employees, stakeholders, and other relevant parties to gather further insights into potential issues. This investigative step helps build a comprehensive understanding of the financial situation and can lead to the discovery of hidden fraud or misconduct.

- Reporting and Findings

After completing the analysis, the forensic accountant will prepare a detailed report outlining the findings of the audit. This report may highlight instances of fraud, errors in financial reporting, or weaknesses in internal controls. The forensic accountant will also provide recommendations for addressing these issues.

- Expert Testimony and Legal Proceedings

In cases where legal action is involved, forensic accountants may be required to testify in court. Their role is to provide expert testimony regarding the findings of the audit, explain complex financial matters in a way that is understandable to judges and juries, and support the case with their professional analysis.

Common Areas Where Forensic Accounting Audits Are Applied

Forensic accounting audits are applied in a variety of industries and situations. Below are some common scenarios where a forensic accountant’s expertise can make a significant difference:

- Corporate Fraud: This includes embezzlement, kickbacks, and other types of financial misconduct. A forensic audit can uncover evidence of fraudulent activities, identify the individuals involved, and support legal action.

- Tax Evasion: Businesses or individuals seeking to evade taxes can be investigated through forensic audits. Forensic accountants can analyze financial records to identify discrepancies that may indicate intentional tax fraud or evasion.

- Bankruptcy and Insolvency: In cases of bankruptcy, forensic accountants are often called in to investigate the financial records of the organization. Their role is to determine whether there was any fraudulent activity that led to the bankruptcy.

- Divorce and Marital Disputes: Forensic accountants can assist in divorce cases by analyzing financial records to ensure fair division of assets. They can also investigate hidden assets or income that may affect the distribution of property.

- Employee Theft and Fraud: In cases where an employee is suspected of stealing from the company, a forensic audit can help uncover the full extent of the theft and provide evidence for legal action.

- Insurance Fraud: In the insurance industry, forensic accountants play a role in investigating fraudulent claims and uncovering evidence that may reveal deliberate misrepresentation or false claims.

The Benefits of Hiring a Professional Forensic Accountant

When considering a forensic accounting audit, it is essential to work with a professional who has the expertise to handle complex financial investigations. Here are some key benefits of hiring a forensic accountant:

- Expertise and Knowledge: Forensic accountants possess specialized skills in financial analysis, fraud detection, and legal procedures. They can navigate complex financial records and provide accurate, actionable insights.

- Credibility and Legal Standing: Forensic accountants are often called upon to provide expert testimony in court. Their findings and testimony are seen as credible and can be used to support legal claims or defend against accusations.

- Thorough Investigations: Professional forensic accountants use advanced techniques and tools to analyze financial data. Their investigations are thorough, ensuring that no discrepancies go unnoticed.

- Efficiency and Objectivity: Forensic accountants bring an objective perspective to the table. They can investigate financial issues without any bias or emotional involvement, ensuring an unbiased outcome.

- Preventing Future Issues: By identifying financial vulnerabilities and suggesting improvements to internal controls, forensic accountants can help businesses prevent future fraud or mismanagement.

Secure Your Financial Integrity Today

A forensic accounting audit is a crucial tool in safeguarding the financial health and integrity of your business. It offers an in-depth analysis that can uncover financial irregularities, detect fraud, and help you comply with legal requirements. Whether you are a business owner concerned about potential risks, a legal professional needing expert insights, or an individual facing a financial dispute, forensic accounting audits provide the necessary expertise to secure your financial future.

Secure your financial integrity today with professional forensic accounting audit services. Whether you’re a business owner looking to safeguard your assets or a legal professional seeking expert insights, we’re here to help. Contact us today at (877)-399-2995 or visit Mortgage Audits Online to learn more. Secure your financial future with confidence!