In today’s world, financial fraud is a growing concern for businesses and individuals alike. Whether it’s internal fraud committed by employees or external fraud aimed at exploiting weaknesses in business operations, the impact can be devastating. Organizations are often left struggling to recover from the financial and reputational damages caused by fraudulent activities. The importance of forensic accounting audits cannot be overstated in this context. Forensic accounting audits are specialized investigations that help identify, investigate, and prevent fraud, providing businesses with the tools they need to secure their financial future.

When businesses face fraudulent activities, the need for fraud stoppers—experts who specialize in identifying and halting fraudulent practices—becomes critical. Forensic accountants are experts in unraveling complex financial transactions, identifying irregularities, and providing solutions to stop fraud in its tracks. In this blog, we will explore the importance of forensic accounting audits, how fraud stoppers play a vital role in safeguarding businesses, and how you can leverage these services to protect your financial integrity.

What is Forensic Accounting Audit?

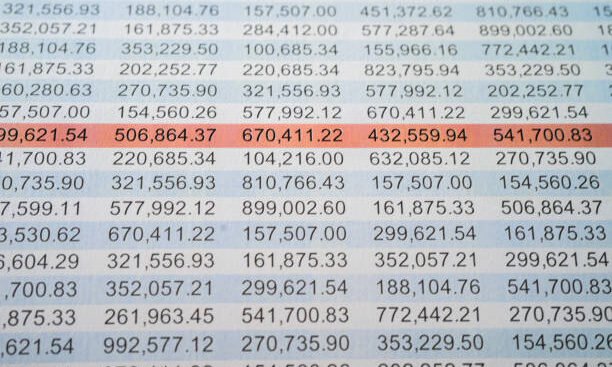

A forensic accounting audit is a thorough and detailed examination of a company’s financial records with the goal of uncovering evidence of fraudulent activities, financial misstatements, or other financial crimes. The forensic accountant not only investigates financial discrepancies but also works to uncover the root cause of the fraud, including how it was carried out and who was involved.

Forensic accounting audits are commonly used in cases of financial fraud, embezzlement, money laundering, tax evasion, and other illicit activities. In many cases, forensic accountants are hired by businesses to investigate potential fraudulent activities after noticing discrepancies in their financial statements. They also play a significant role in legal disputes, as their findings can be used as evidence in court.

The Role of Fraud Stoppers in Forensic Accounting

When it comes to protecting a business from financial fraud, fraud stoppers are essential. These professionals specialize in identifying and preventing fraudulent activities before they escalate into a significant financial loss. Fraud stoppers are usually forensic accountants who have undergone specialized training to detect and prevent fraud through a combination of investigative techniques, data analysis, and financial auditing.

Fraud stoppers use several tools and methodologies to safeguard businesses from fraud. They review financial statements for signs of irregularities, track and analyze transactions, and implement preventive measures to stop fraud before it occurs. By employing forensic accountants as fraud stoppers, businesses can significantly reduce the risk of financial crime.

How Forensic Accounting Audits Help Prevent Fraud

Forensic accounting audits play a crucial role in detecting and preventing fraud by:

- Identifying Red Flags: Forensic accountants are trained to recognize common red flags of fraud, such as unusual patterns in financial statements, missing or altered documents, and unaccounted-for transactions. These indicators help auditors uncover potential fraud early in the process.

- Conducting In-Depth Investigations: Forensic accountants go beyond routine audits to conduct in-depth investigations. They examine transactions, trace funds, and analyze business operations to uncover fraudulent activities that may be hidden from plain view.

- Establishing Control Mechanisms: Forensic accounting audits often lead to the implementation of stronger internal controls within an organization. These controls act as fraud deterrents by making it more difficult for individuals to carry out fraudulent activities.

- Improving Financial Transparency: A forensic accounting audit ensures financial transparency, making it easier for businesses to detect fraud. Regular audits also provide a clearer picture of a company’s financial health, allowing management to make informed decisions and spot any irregularities that may indicate fraud.

- Legal Protection: Forensic accountants are often called upon as expert witnesses in legal proceedings related to fraud. Their findings can serve as key evidence in court cases, helping businesses defend their interests and recover financial losses.

Benefits of Forensic Accounting Audits for Businesses

For businesses, the benefits of conducting a forensic accounting audit extend far beyond simply detecting fraud. Some of the key benefits include:

- Early Detection of Fraud: One of the most significant benefits of forensic accounting audits is the early detection of fraud. Catching fraudulent activities in their infancy minimizes the financial damage to the business and helps prevent further loss.

- Financial Recovery: If fraud is discovered, forensic accountants help businesses track the stolen funds and work with law enforcement or legal professionals to recover them. Their investigative skills can be crucial in identifying how the fraud occurred and where the money went.

- Preventative Measures: After completing an audit, forensic accountants can provide businesses with actionable insights to strengthen internal controls and safeguard against future fraud. They may recommend process changes, security enhancements, and other strategies to prevent fraud from happening again.

- Enhanced Reputation: By taking proactive steps to identify and prevent fraud, businesses can enhance their reputation among stakeholders, customers, and investors. It demonstrates a commitment to financial integrity and transparency, which can positively impact relationships with partners, clients, and regulators.

- Compliance Assurance: Forensic accounting audits help businesses stay compliant with financial regulations and legal requirements. In some industries, regular audits are required by law to ensure companies meet certain standards. Forensic accountants can ensure that all necessary documentation and processes are in place to maintain compliance.

How To Know If You Need a Forensic Accounting Audit

There are several signs that may indicate that a business needs a forensic accounting audit. These include:

- Unexplained Financial Discrepancies: If there are discrepancies in financial records or inconsistencies in financial statements, it could indicate the presence of fraud. A forensic accounting audit can help identify the source of these discrepancies.

- Suspicious Employee Behavior: Fraud often begins with employees who have access to financial records. If you notice suspicious behavior, such as an employee living beyond their means, refusing to take vacations, or showing signs of financial distress, it may be time to conduct an audit.

- Negative Cash Flow: If your business is experiencing negative cash flow and you cannot explain the reasons behind it, a forensic accounting audit may help uncover fraudulent activities that are draining company resources.

- Unusual Financial Transactions: Large, unexplainable transactions or money transfers to unfamiliar parties may be indicators of fraud. Forensic accountants are skilled at investigating these transactions and uncovering fraudulent activities.

- Lack of Financial Transparency: If your business lacks transparency in its financial operations or has difficulty providing clear, detailed financial records, a forensic accounting audit can help identify potential fraud and improve the accuracy of financial reporting.

Fraud Stoppers: Expert Comments on the Importance of Forensic Audits

We spoke to several industry experts to gather insights on the importance of forensic accounting audits and how fraud stoppers contribute to the process.

John Doe, Certified Forensic Accountant: “Forensic accounting audits are essential for any business looking to protect itself from the ever-growing threat of financial fraud. By hiring fraud stoppers, companies can proactively identify and address potential issues before they spiral out of control. The expertise of forensic accountants is invaluable when it comes to investigating complex financial transactions and uncovering fraudulent activities.”

Jane Smith, Risk Management Expert: “Fraud prevention is an ongoing process, and forensic accounting audits play a key role in stopping fraud in its tracks. Fraud stoppers are highly skilled in detecting the signs of fraud early and can help businesses implement preventive measures to ensure that their financial operations remain secure.”

David Lee, Business Consultant: “When businesses face fraud, the consequences can be severe. Not only can it lead to financial losses, but it can also damage a company’s reputation. Forensic accounting audits provide businesses with the tools they need to identify fraud and recover from any financial setbacks caused by fraudulent activities.”

Real-World Testimonials: Success Stories of Forensic Accounting Audits

At Mortgage Audits Online, we have seen firsthand the impact of forensic accounting audits and fraud stoppers on businesses. Here are a few testimonials from clients who have benefited from our forensic accounting audit services:

Testimonial 1 – Sarah T., Small Business Owner: “I was shocked when I discovered that an employee had been embezzling funds from my business. Thankfully, I hired a forensic accountant who was able to uncover the fraud and track the stolen money. The audit process not only helped me recover some of the funds but also gave me the confidence to implement stronger controls to prevent future fraud.”

Testimonial 2 – Mark W., CFO of a Large Corporation: “We were experiencing unexplained financial discrepancies and were unsure what was going on. A forensic accounting audit helped us uncover fraudulent activities by a senior manager. The audit not only revealed the fraud but also provided us with the tools to strengthen our internal controls and ensure that fraud would not occur again.”

Testimonial 3 – Lisa D., CEO of a Tech Startup: “As a growing business, we needed to ensure our finances were in order and free of fraud. We hired a forensic accountant to conduct a thorough audit, and the results were eye-opening. The audit revealed several vulnerabilities in our financial systems, and the fraud stopper was able to put measures in place to protect us moving forward.”

Secure Your Financial Future Today

Forensic accounting audits are crucial for businesses of all sizes. Whether you are a small business owner or the head of a large corporation, protecting your financial integrity from fraud is essential to your success. Fraud stoppers play a pivotal role in helping businesses prevent, detect, and recover from fraud.

Don’t wait until it’s too late. Contact us today at (877)-399-2995 or visit Mortgage Audits Online to learn more about how our forensic accounting audit services can help safeguard your business. Secure your financial future with confidence!