In today’s complex financial world, ensuring that your business operations are free from fraud or financial mismanagement is crucial. One powerful tool to achieve this is forensic accounting audits, a specialized field of accounting that digs deep into financial records to uncover discrepancies, fraud, or any financial irregularities. Forensic accounting audits are indispensable for businesses, legal professionals, and organizations that seek to protect their assets, ensure compliance, and defend against financial crimes.

This blog explores the importance of forensic accounting audits, the process involved, how they can benefit your business, and why you should consider professional forensic accounting services.

What is Forensic Accounting?

At its core, forensic accounting is the integration of accounting, auditing, and investigative skills to examine financial records and identify potential fraud, embezzlement, money laundering, or financial misrepresentation. Unlike traditional accounting, which focuses on managing and reporting financial transactions, forensic accountants seek to identify issues that could affect the integrity of financial reporting and business operations.

Forensic accountants are often involved in legal disputes, corporate investigations, or in any scenario where financial transparency is vital. Their expertise allows them to detect subtle signs of financial wrongdoing that might not be immediately evident to the untrained eye. Whether you’re dealing with employee fraud, litigation support, or business valuations, forensic accounting audits provide a critical layer of financial security.

Key Benefits of Forensic Accounting Audits

- Uncovering Financial Fraud

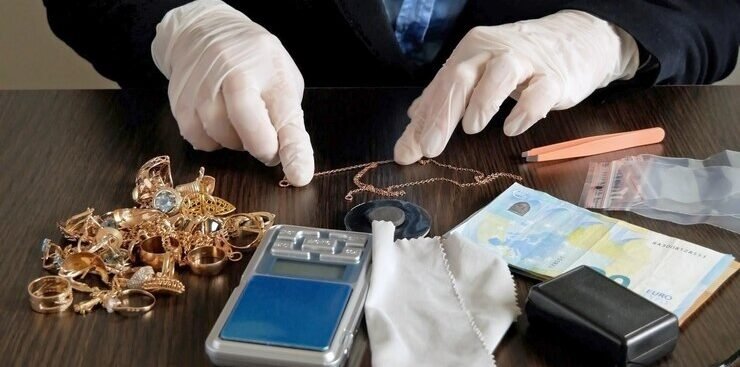

One of the primary reasons to engage in a forensic accounting audit is to uncover fraud. In business, fraud can take many forms—whether it’s employees misappropriating funds, manipulating financial statements, or falsifying records to cover up illicit activities. A forensic audit is designed to investigate financial records meticulously to detect fraudulent activities.

Forensic auditors employ specialized techniques, including reviewing internal controls, tracing asset movements, and analyzing financial transactions in detail to identify any red flags that may point to fraudulent activities. This is essential for businesses that want to ensure their finances are secure and avoid costly damage to their reputation.

- Litigation Support and Legal Disputes

Forensic accountants play a crucial role in legal proceedings, particularly in cases involving financial disputes. They assist lawyers by providing expert testimony, analyzing complex financial transactions, and offering insights into the financial aspects of the case.

Whether it’s in divorce proceedings, contract disputes, or shareholder disagreements, forensic accounting audits provide critical support for attorneys and legal teams. By thoroughly examining financial documents and offering professional interpretations, forensic accountants ensure that all financial issues are accounted for and presented in a clear and understandable way for the court.

- Risk Management and Prevention

A forensic audit doesn’t just help in identifying fraud or errors—it can also play an essential role in preventing financial misconduct from occurring in the first place. By thoroughly reviewing financial records and assessing an organization’s internal control systems, forensic accountants can identify weaknesses and provide recommendations to enhance those systems.

Implementing the recommended changes can help reduce the likelihood of fraud and financial mismanagement in the future. This proactive approach to risk management ensures that businesses can operate smoothly and confidently, without worrying about internal or external financial threats.

- Improving Financial Transparency

Transparency is key in maintaining trust with stakeholders, investors, and customers. A forensic accounting audit enhances financial transparency by providing an independent review of your financial operations. This is particularly important for businesses in highly regulated industries or those looking to attract investors.

A transparent financial environment increases the credibility of your organization, providing stakeholders with the confidence that your financial reports are accurate and that your business is compliant with relevant laws and regulations.

How Forensic Accounting Audits Work

Forensic accounting audits are distinct from standard audits in several ways. While traditional audits aim to ensure that financial records are accurate and compliant with accounting standards, forensic audits focus on detecting and investigating fraudulent activity, financial misstatements, or other irregularities.

- Data Collection and Analysis

The first step in a forensic accounting audit is gathering data. Forensic accountants collect financial records, such as balance sheets, income statements, bank statements, and transaction histories, and begin reviewing them in detail. They use specialized software to analyze large volumes of data and identify potential discrepancies or fraudulent patterns.

- Transaction Tracing and Examination

Once the necessary documents are collected, forensic accountants trace the flow of transactions. They look for unusual patterns, such as unexplained transfers, discrepancies in receipts, or transactions that don’t match up with the business’s typical operations. By examining these transactions, forensic accountants can identify any suspicious activity or financial misconduct that needs further investigation.

- Interviews and Fact-Finding

Forensic auditors may also conduct interviews with employees, management, and other relevant parties to gather additional information and insights. These interviews help the auditors understand the context of certain financial activities and identify whether there was any intention behind questionable transactions. Forensic accountants may also examine the internal controls within the organization to assess whether employees had opportunities to commit fraud.

- Reporting and Recommendations

After completing the investigation, forensic accountants compile their findings into a detailed report. This report outlines any discovered discrepancies, fraud, or errors and provides recommendations for rectifying the issues. In many cases, the findings are used as evidence in legal proceedings, and forensic accountants may be called to testify as expert witnesses.

Why Choose Forensic Accounting Services?

While forensic accounting audits can be conducted internally, many businesses and legal professionals prefer to hire specialized forensic accountants for several reasons.

Expertise and Objectivity

Forensic accountants have specialized training and experience in detecting fraud, financial mismanagement, and other financial discrepancies. They bring a level of expertise that internal auditors may not have, especially in complex cases of fraud or financial misconduct.

Moreover, forensic accountants are independent and objective, ensuring that their findings are unbiased and based purely on the facts. This neutrality is essential in situations where the integrity of the financial records is in question.

Legal Support

Forensic accounting audits are often used in legal proceedings, and the reports generated by forensic accountants are often admissible in court. Forensic accountants are skilled in presenting their findings in a manner that is understandable and legally sound, which is crucial for businesses or legal teams involved in disputes.

Cost-Effectiveness

While hiring forensic accounting services may seem like an upfront investment, the cost is often far less than the financial damage caused by undetected fraud, regulatory penalties, or legal fees arising from financial mismanagement. Forensic audits can also help businesses recover misappropriated funds or prevent further financial loss.

Industries That Benefit from Forensic Accounting Audits

Forensic accounting audits are valuable across various industries. Here are just a few of the sectors that can benefit significantly from forensic accounting services:

- Healthcare

Healthcare organizations deal with vast sums of money, making them particularly vulnerable to fraud, such as fraudulent billing, overbilling, or misappropriation of funds. Forensic accountants in the healthcare sector ensure that claims are accurate and that financial records comply with relevant regulations.

- Government and Public Sector

Government agencies and public organizations are at constant risk of fraud and misallocation of resources. Forensic accountants help ensure that public funds are spent correctly and that government contracts are managed transparently.

- Banking and Finance

Banks and financial institutions face complex financial transactions and high amounts of regulatory scrutiny. Forensic accounting audits are used to investigate suspicious activities, money laundering, and financial mismanagement.

- Corporate Sector

Forensic accounting audits are widely used in the corporate world to safeguard against financial mismanagement, employee theft, or irregularities in corporate financial statements.

The Importance of Acting Quickly

The longer fraudulent activities or financial mismanagement goes undetected, the more difficult it becomes to recover lost funds and restore financial integrity. Forensic accounting audits are an essential tool for detecting and addressing financial discrepancies promptly. The sooner you identify issues, the faster you can take corrective actions to protect your assets and minimize potential damage.

Secure your financial integrity today with professional forensic accounting audit services. Whether you’re a business owner looking to safeguard your assets or a legal professional seeking expert insights, we’re here to help. Contact us today at (877)-399-2995 or visit Mortgage Audits Online to learn more. Secure your financial future with confidence!